New IPO Watch | Hongxing Coldchain (Hunan) Co., Ltd. (01641.HK): Regional Cold Chain Leader Launches Hong Kong IPO, Strong Profitability Model Coexists with Regional Challenges

Hongxing Coldchain (Hunan) Co., Ltd. (Stock Code: 01641.HK) launched its public offering on December 31, 2025, which will close on January 8, 2026. It is expected to list on January 13, 2026. The offer price has been set at HK$12.26 per share, with a board lot of 500 shares and an entry cost of approximately HK$6,191.83. The total fundraising amount is expected to be around HK$252 million. Newtimespace observes that as a leading player in the cold chain market in Central China and Hunan Province, Hongxing Coldchain demonstrates strong regional competitiveness and profitability through its unique business model. However, its listing performance will be influenced by multiple factors, including its highly regionalized operations, challenges at its northern facility, and the competitive landscape of the market.

Key Highlights: Regional Market Position and Business Model

Regional Market Leadership: According to Frost & Sullivan's report, based on 2024 revenue, Hongxing Coldchain holds a 0.7% share in China's frozen food warehousing services market. It ranks first in both the Central China region and Hunan Province within this segment, with market shares of 2.6% and 13.6%, respectively. In the frozen food shop leasing services market, the company is the second-largest provider in Central China with an 8.8% share, and the largest in Hunan Province with a 54.7% share.

"Warehousing + Shops" Integrated Model: The core of the company's business model lies in combining self-operated frozen food warehousing with matching shop leasing for trading activities. This model has established a regional cold chain hub at its southern base in Changsha. During the track record period, the average capacity utilization rate at the southern warehousing base exceeded 90%, and the shop occupancy rate surpassed 94%.

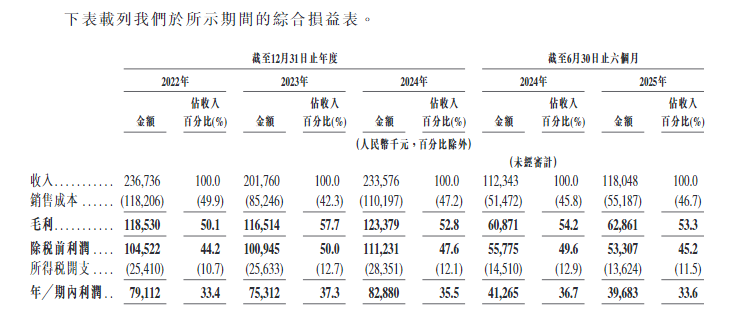

Financial Performance and Profitability: The company's historical financial data indicates strong profitability. For 2022, 2023, 2024, and the six months ended June 30, 2024, and 2025, the company generated revenues of RMB 236.7 million, RMB 201.8 million, RMB 233.6 million, RMB 112.3 million, and RMB 118.0 million, respectively. Corresponding gross profit margins were 50.1%, 57.7%, 52.8%, 54.2%, and 53.3%. Net profits for the same periods were RMB 79.1 million, RMB 75.3 million, RMB 82.9 million, RMB 41.3 million, and RMB 39.7 million, with net profit margins of 33.4%, 37.3%, 35.5%, 36.7%, and 33.6%, respectively.

Source: IPO prospectus.

Offer Details: Shareholding Structure and Issuance Information

Hongxing Coldchain plans a global offering of approximately 23.26 million shares at a price of HK$12.26 per share. With a board lot of 500 shares and an entry cost of approximately HK$6,191.83, the estimated net proceeds are around HK$252 million. The public offering portion will close on January 8, with listing expected on January 13. As of January 5, the company recorded HK$74 million in margin financing, with the public offering portion receiving approximately 1.60 times oversubscription.

Newtimespace observes from the prospectus that, as of the last practicable date, Hongxing Industrial Co., Ltd. controls approximately 70.97% of the voting rights in the company. This includes a direct holding of 58.25% and an indirect control of approximately 12.72% through employee and partner holding platforms—Hongri Jingming and Hongri Mingsheng—for which it serves as the general partner. Hongxing Industrial is wholly owned by the Hongxing Village Collective Assets Management Center, a collectively owned enterprise owned by over 2,000 villagers of Hongxing Village and managed by a council of villager representatives.

Risk Focus: Regional Concentration, Operational Divergence, and Market Competition

Risk of High Regional Concentration: The company's primary operating revenue is derived from Hunan Province. Its business growth is closely tied to regional economic development and cold chain demand. While this structure reinforces regional advantages, it also means growth potential and risk diversification are bound to a single regional market.

Ongoing Operational Pressure at Northern Base: Financial data shows a downward trend in operational indicators at the company's northern frozen food warehousing base. Capacity utilization dropped from 85.0% in 2022 to 45.9% in the first half of 2025, and the number of clients decreased from 279 to 23. This base recorded net losses in both 2023 and the first half of 2025, posing an operational challenge to the overall business.

Intensifying Industry Competition and Threat of New Entrants: China's cold chain warehousing market is characterized by high fragmentation and regional competition. The prospectus discloses that a Hong Kong-based industry company plans to enter the Changsha market, expecting to increase warehousing capacity and shop supply locally. The entry of new competitors may impact the existing market competitive landscape.

Short-Term Profitability Pressure from Expansion: The company expects that due to increased depreciation and amortization costs from newly operational projects at its southern base, along with commercial measures implemented to retain clients, the gross profit margin of its frozen food warehousing services in 2025 may face year-on-year downward pressure.

Conclusion

Hongxing Coldchain's Hong Kong listing presents the current development status of a regional cold chain service provider. The company has established a leading position in its core market and achieved stable profitability through its unique business model. Simultaneously, its business development faces practical factors such as high regional concentration, the need for operational improvement at its northern base, changes in the industry competitive landscape, and rising costs during expansion. Post-listing, how the company addresses these challenges while consolidating its existing regional advantages will influence its long-term development path.