NewTimeSpace丨Leadrive Technology, China's Leading Power Brick Provider for Dual-Motor Controllers, Plans Hong Kong IPO

Recently, Leadrive Technology (SHANGHAI) Co., Ltd. (hereinafter referred to as "Leadrive Technology") filed a prospectus with the Hong Kong Stock Exchange for a listing on the Main Board, with CITIC Securities and Haitong International as joint sponsors.

Source: Prospectus

**China's Leading Power Brick Provider for Dual-Motor Controllers**

Public information shows that Leadrive Technology, founded in 2017, is a technology-driven new energy vehicle electronic control solutions provider. The company has built a layered product portfolio covering complete solutions ranging from basic power modules and integrated motor controllers to modular "power bricks," enabling customers to flexibly choose electronic control systems with different integration levels based on vehicle design, cost, and engineering requirements.

The company pioneered and industrialized the "power brick" architecture, which began mass production in 2021, effectively simplifying the assembly process of electronic control systems, improving platform reusability, and shortening development cycles. Additionally, Leadrive Technology has extended the power brick architecture to low-power controllers in the powertrain and chassis domains (such as clutch controllers, power supply units, etc.), and can provide domain controller solutions integrating multiple control functions to enhance vehicle control efficiency.

As of September 30, 2025, the company has obtained 50 project designations from 13 OEMs either directly or through tier-1 suppliers. Its solutions have been applied to 82 vehicle models, of which 54 models have achieved mass production. While consolidating its position in the automotive sector, the company is expanding its core electronic control technology to emerging fields such as electric vertical take-off and landing aircraft (eVTOL) and embodied intelligence.

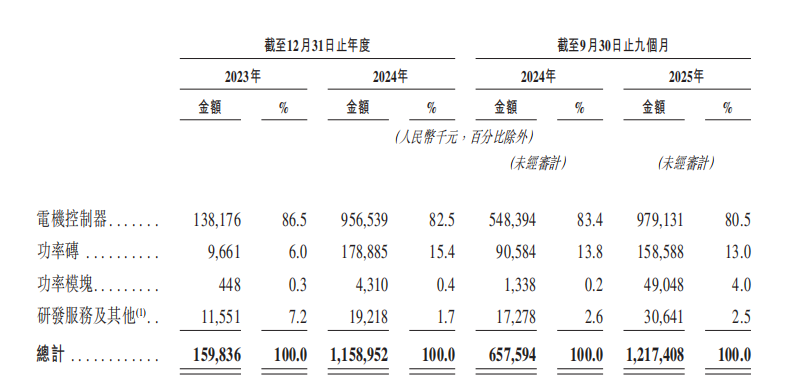

In terms of revenue composition, the company primarily derives income from motor controller sales, followed by power bricks, power modules, R&D services, and other related revenue.

According to Frost & Sullivan, by installed capacity in the first three quarters of 2025, the company's motor controllers ranked eighth, dual-motor controllers ranked third; main drive power bricks ranked second, and power bricks for dual-motor controllers ranked first.

**Revenue Exceeds RMB 1.2 Billion, Performance Remains in Loss Position**

Regarding financial performance, the prospectus shows that for 2023, 2024, and the first nine months of 2025, Leadrive Technology's operating revenue was RMB 160 million, RMB 1.159 billion, and RMB 1.217 billion, respectively, with corresponding net losses of RMB 237 million, RMB 335 million, and RMB 257 million.

Source: Prospectus

From a revenue structure perspective, motor controllers are the main pillar of Leadrive Technology's revenue, accounting for 86.5%, 82.5%, and 80.5% of revenue during the reporting period, respectively.

Apart from the core business, power bricks, power modules, R&D services, and other businesses contributed 13%, 4%, and 2.5% of revenue, respectively, in the first three quarters of 2025.

The prospectus shows that Leadrive Technology's customers mainly include automotive OEMs and tier-1 suppliers. During each period of the reporting period, revenue from the top five customers accounted for 86.1%, 92.0%, and 94.0%, respectively, indicating high customer concentration.

Leadrive Technology stated in its prospectus that the loss of major customers, order reductions, failure to obtain new platform projects, or delays in customer production schedules could all lead to significant fluctuations in revenue and profitability. Acquiring new customers or replacing lost business may require substantial time and resources and may not fully offset the impact of reduced orders from existing customers.

According to research, Leadrive Technology's financial costs showed a significant upward trend in the first three quarters of 2025. Data shows that compared with the same period in 2024, the company's bank loan interest expenses increased from RMB 8.347 million to RMB 32.007 million, and interest expenses on liabilities to other investors increased from RMB 527,000 to RMB 7.046 million.

As of September 30, 2025, Leadrive Technology held cash and cash equivalents of RMB 500 million.

**Post-Investment Valuation Exceeds RMB 4 Billion, Legend Capital and Lenovo Capital Among Investors**

The Frost & Sullivan report shows that with the rapid development of emerging industries such as new energy vehicles, eVTOL, embodied intelligent robots, and AI data centers ("AIDC"), electronic control systems are upgrading from energy conversion units to high-performance, intelligent control systems, imposing higher technical requirements for power density, control algorithms, and system integration, with solutions such as power bricks reflecting this integrated development direction.

The electronic control market is in a rapid expansion phase. From 2020 to 2024, the global electronic control market size increased from RMB 383.1 billion to RMB 446.3 billion, with a compound annual growth rate of approximately 3.9%; it is expected to maintain stable growth at a compound annual growth rate of approximately 5.3% from 2025 to 2030, reaching a market size of approximately RMB 608.4 billion by 2030.

The prospectus shows that since 2017, Leadrive Technology has obtained as many as 12 financing rounds, with the most recent E-2 round completed in September 2025, raising RMB 210 million, of which Advanced Manufacturing Fund subscribed for RMB 100 million, China Internet Investment Fund subscribed for RMB 50 million, and Shanghai Pilot Zone Fund subscribed for RMB 30 million.

Data shows that Leadrive Technology raised a total of RMB 580 million in 2025, with a post-investment valuation of RMB 4.28 billion after completing the E-2 round, and a per-share cost of RMB 24.67.

Pre-IPO, Dr. Shen Jie, the founder of Leadrive Technology, directly holds and controls a total of 30.79% of shares, making him the single largest shareholder. Other investors include Legend Capital, Advanced Manufacturing Fund, CICC Qichen, Lenovo Capital, Jiaxing Jingkai, Yuan He, Zhangjiang Hi-Tech Investment, Schaeffler Investment, Chongqing Liangjiang Fund, Volvo, Guangzhou Industrial Investment, C Capital, and Ruihe Venture Capital, among others.

Leadrive Technology stated in its prospectus that the proceeds from this IPO are intended to be used for: accelerating innovation and R&D of existing products, new products, and forward-looking technologies, enhancing R&D capabilities and enriching our product matrix; improving domestic delivery capabilities, optimizing intelligent systems, strengthening lean management capabilities and operational efficiency; advancing internationalization strategies, deepening influence in overseas markets and building localization capabilities; incubating deep strategic cooperation with leading technology enterprises in the industrial chain and emerging frontier fields; repaying short-term bank loans and potential investments; and as working capital and other general corporate purposes.

NewTimeSpace Disclaimer: All content herein is the original work of NewTimeSpace. Any reproduction, reprinting, or use of this content in any other manner must clearly indicate the source as "NewTimeSpace". NewTimeSpace and its authorized third-party information providers strive to ensure the accuracy and reliability of the data, but do not guarantee the absolute correctness thereof. This content is for reference only and does not constitute any investment advice. All transaction risks shall be borne by the user.